Powerful silver deficit secret no secret! But will impact headlines absolutely…

Bullion.Directory precious metals analysis 27 April, 2016

Bullion.Directory precious metals analysis 27 April, 2016

By Adrian Ash

Head of Research at Bullion Vault

Mining output won’t be large enough to meet demand this year, reports Bloomberg.

Cue the bug-o-sphere to light up…as hot-money hedge funds rationalize their largest-ever speculative betting on Comex derivatives…and Twitter dusts down #silvershortage as a hashtag.

Because at last! The “shortage talk [is] now on MSM” – meaning “mainstream media” to red-pill initiates.

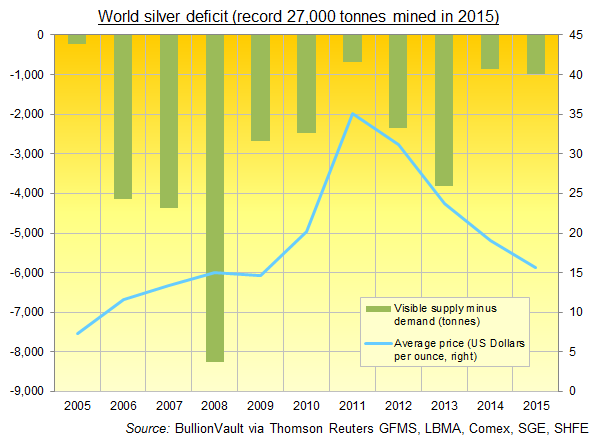

Trouble is, world silver supply hasn’t met demand anytime since at least 2003 on the best available data.

In fact, the deficit between visible silver supply and demand totals maybe 984 million ounces over the last decade…

…a massive shortfall of 30,615 tonnes since 2006 according to our number-crunching off data compiled and published by Thomson Reuters GFMS.

That equals 114% of last year’s record-high global silver mining output. It’s more than 2.5 times the current holdings of the giant iShares Silver Trust fund investing product (NYSEArca:SLV). It dwarfs even the near-record high notional silver exposure now held by leveraged speculators in Comex silver futures and options, net of their bearish bets.

So there’s nothing new about this gap. In fact, last year’s gap came at the smaller end of silver-market deficits since the middle of last decade, somewhere around 3.7% of newly-mined silver output.

But here in spring 2016, with silver prices 27% above New Year, this kind of thing will make headlines in just the way it didn’t when we first noted it to readers of BullionVault’s Update emails last November…back when prices were slumping.

So far this month, silver has gained 12% versus the Dollar to reach 11-month highs. Bloomberg has carried six articles with silver prices cited in the headline.

A quick (and unscientific) survey via Google says that’s as many silver-price headlines as Bloomberg published across all of the last 3 months of 2015, when silver dropped 5% to a run of new 6-year lows.

Still, the silver deficit is stunning…absolutely. Even more so when you see just how large and long-lived the gap has become.

Where has this metal come from to sate this physical buying? Bullion-bank stockpiles? Unreported central-bank hoards? Behind the sofa at the major silver refineries?

It certainly hasn’t come from the ‘paper’ markets of Comex futures or options. Because the physical data throw out this huge gap…and physical buyers cannot make solar panels or bullion coins out of derivatives.

Maybe the data are wrong? For what it’s worth, our chart above shows numbers from specialist analysts GFMS, plus a couple of other sources added to an estimate of the 2015 figure. They give the net balance betweeen:

Supply

Mine production (new record, growing for 13 years)

Net government sales (averaged some 7% of mine output in decade to 2011, but China, India and Russia now stopped)

Scrap from silverware & industry (peaked with prices in 2011; lowest in at least 10 years in 2014)

Net hedging supply (forward sales by miners to lock in prices now tiny after going negative during boom and bust)Demand

Jewelry (steadily growing)

Coins & bars (four times the weight of a decade ago)

Silverware (recovering but lower from 2006)

Industrial fabrication (trending lower), led by:

– electricals & electronics (growing slowly)

– brazing alloys & solders (ditto)

– photography (not quite dead yet)

– photovoltaic (surging again on fresh solar-energy subsidies and investment)

Plus the net change in exchange-traded investing trust funds (ETFs) and in reported inventories for futures exchanges such as the CME and SHFE.

Those last two don’t come under GFMS’s own definition of “Physical Surplus/Deficit”. Instead, their tables put exchange-traded inventories below that line…to give what those specialists call the “Net Balance”…which to my mind better matches the idea of a “deficit or surplus” on the visible movements overall.

A bit Council of Nicea, perhaps. But how you account silver-investing stockpiles really does matter. First because those piles are physical. Second because only investing demand will chase prices higher. (Well, photovoltaic demand aside, that is. But the solar-energy sector barely existed a decade ago. Government subsidies and ‘green’ incentives have since trumped Mr.Market despite huge thrifting by the industry.)

But how come the shortfall hasn’t seen prices rise and keep rising…forcing more metal out of existing investment and jewellery holdings to plug the gap?

Sadly, and after asking plenty of people who might know or have a good guess, we’re no wiser now than when we first flagged this large and persistent silver deficit late last year.

But we might be more cautious than some headline writers, analysts or silver speculators in thinking that a likely deficit this year will drive prices higher. Because there’s no such pattern that we can spot

The last decade has seen silver’s world market deficit swing from 3% of annual mining output…way up to 39%…and back again, expanding or shrinking both on rising or falling prices.

No doubt the deficit is important. Almost as important as the data gaps or hidden source of supply which feeds it. But what it means for prices, so far no one seems to know either. And how long this silver anomaly might have left to run is just as much a mystery as how it comes about.

Is it bullion-bank stockpiles?

Perhaps. But London’s vaults, by all accounts, have already got through the mountain of metal melted down from silverware after the big $50 top of January 1980. Unreported central-bank hoards? Could be. But GFMS already include net government sales in their supply data, as noted above.

A mystery then, for now. Perhaps even news. But it really isn’t new.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply