Understanding the difference between probability versus possibility will help make you a better investor

Bullion.Directory precious metals analysis 12 September, 2014

Bullion.Directory precious metals analysis 12 September, 2014

By Terry Kinder

Investor, Technical Analyst

The fact that something is possible, doesn’t mean it’s probable.

Even if you believe something is probable, or likely to happen, that information isn’t of much use until you put a number on it.

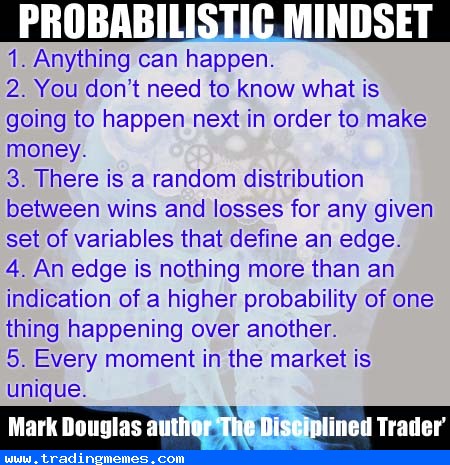

Learning to think in terms of numerical probabilities, or probabilistic thinking, is an important skill to learn in investing.

Source: Tradingmemes.com

Barry Ritholtz, over at The Big Picture, framed the difference between probability versus possibility quite nicely:

Let’s define the terms Possible and Probable so that we all begin with the same basic understanding of these words. Something that is Possible may — or may not — come to be. There is no statistical insight provided, it is merely an outcome that may or may not come to pass. It is possible that you could get hit by lightning, or win the lottery, or marry a supermodel. When we describe something as possible, we mean there is a non-zero likelihood of that outcome — it could happen; we just don’t know if it will or will not, but it might.

What seems to confuse investors about possible is the statistical likelihood of occurrence. Can a company on the verge of bankruptcy go on to become the biggest company in the world? It is possible — and Apple (AAPL) did just that over the course of a 15 year from 1998-2012. But think about all of the many tens of thousands of companies that have been on the verge of going belly up. Is it possible that they could do the same? Well, the answer is Yes, it is theoretically possible — but not very probable. And indeed, experience teaches us that most insolvent and near insolvent firms actually do go bankrupt eventually.

Probability is a the term for the branch of statistics dealing with chance and outcome.

Possibility is binary — can this happen or not?

Probable is more nuanced mathematics — there is a n% chance of a given outcome, where n = a number between 0-100.

Not everyone agrees with probabilistic thinking. Lars P. Syll labels it probabilistic reductionism.

Mr. Syll writes:

…one could argue that there is simply not enough of adequate and relevant information to ground beliefs of a probabilistic kind, and that in those situations it is not really possible, in any relevant way, to represent an individual’s beliefs in a single probability measure.

However, in investing, the above argument often does not apply. You can assign a numerical probability, either as a number from 0-1, or as a percentage. I prefer using a percentage. Whatever method you use, 0-1, or percentage, the total of all your choices, when added together, must equal either 1 or 100 percent.

While assigning a numerical probability may seem like a guess at first, with practice it gets easier. Just consider the example of the weatherman. Over the years, meteorologists have had to make their forecasts in terms of percentages. For example, they may forecast a 65% chance of rain. While they aren’t always right, this method of forecasting has helped them to increase their accuracy over time. The weatherman can compare their forecast with the outcome and learn from their mistakes. By using the same idea with our own investing, we can improve our ability to make forecasts. Below is an example of an investment I have been studying and how the percentage probabilities are applied.

Recently I have been looking at buying shares of JNUG – the Direxion Junior Gold Miners Index Bull 3X ETF. After some study, I noticed that the JNUG ETF price follows a fairly regular price cycle. In addition, I have come up with a way to calculate high and low prices, using the price crossover, between JNUG and the US Dollar Index (DXY). Using the crossover, the forecast for high and low prices is accurate to within about two dollars. Price moves, from low to high in the past, have been in the range of 100 to 200 percent. So, looking at this idea in terms of possible price moves, it seems like a good investment.

However, I want to weigh this investment based on probabilities versus possibilities. So, I came up with four possible outcomes and assigned a percentage probability for each:

1) JNUG and DXY crossover on chart overlay as they have the four previous times – 80% probability;

2) JNUG and DXY prices both climb higher. They do not cross – 1% probability. I believe the chance is less than that, but we’ll call it that for now;

3) DXY and JNUG prices both climb. Then, the JNUG price declines rapidly. They do not crossover – 10% probability;

4) JNUG and DXY prices both climb. DXY price moves down, but not sharply enough to cross JNUG – 9% probability

There are, of course, other possible outcomes. But, to me, these four seemed to be the most likely ones. The 80% probability for the crossover to occur is quite conservative since it has crossed over 100% of the time to date. However, this time, the pattern is different enough that I prefer to be cautious. The DXY price on the chart overlay is significantly higher above the JNUG price than it has been in the past. So, it seemed like a good idea to assign an 80% probability rather than a 90% or higher one.

Now, all of this is a best guess. However, going through the process forced me to consider different outcomes, and attempt to assign a numerical probability for each one. I could have said that the crossover, as had happened in the past was likely, highly likely, almost certain, etc., and left it at that. But, assigning percentages caused me to think more about probable outcomes, rather than vaguely considering the possible.

Conclusion:

Considering probability versus possibility is valuable because it forces you to think about your investment in terms of numerical probabilities. This probabilistic thinking will force you to consider various outcomes that you might not have if you only considered possibilities.

Understanding probability versus possibility will allow you examine your investment ideas in terms of numerical probabilities. Over time, this process will allow you to measure how accurate your probability forecasts have been, and to improve your ability to correctly weigh the likelihood of one or more outcomes.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply