‘Momentum Traders’ Keep Gold Prices Near 3-Month High Ahead of Trump, Yellen Speeches

Bullion.Directory precious metals analysis 27 February, 2017

Bullion.Directory precious metals analysis 27 February, 2017

By Steffen Grosshauser

European Operations Executive at Bullion Vault

Gold traded in a $6 range around last week’s close of $1257 per ounce, near the highest level since Trump’s presidential election victory last November.

The US Dollar retreated from Friday’s rally on stronger US housing data, dropping against the Euro but holding firm versus the the British Pound, which fell amid rumors that UK Prime Minister May is preparing for a second Scottish independence referendum as fall-out from the move to begin Brexit from the European Union.

Donald Trump speaks to the US Congress on Tuesday night, most likely focusing on economic policy – expected to spend on infrastructure and cut taxes to boost the US economy.

Federal Reserve vice-chair Stanley Fischer then speaks on ‘Monetary Policy Decision-Making’ at a forum in New York Thursday.

With 2 weeks until the Fed’s key March meeting, chair Yellen will address the ‘Economic Outlook’ in a speech in Chicago on Friday.

“The biggest driver of gold has been the relatively weak US Dollar,” reckons Jiang Shu, chief analyst at Chinese gold mining group Shandong.

“People think that…Trump doesn’t want a strong Dollar and the market thinks that perhaps there would not be a rate hike in the first half of the year.”

Gaining 9% so far in 2017, gold’s rising price will now “draw more and more momentum traders into the market,” Shu adds.

Comex gold derivatives bets grew yet again last week, new data showed Friday, with hedge funds and other money managers increasing their bullish position – net of bearish contracts – to the highest in almost 3 months in the week to 21 February.

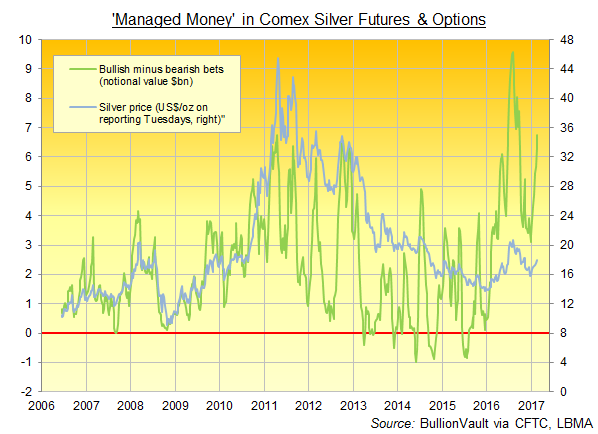

Silver’s net speculative long position of ‘Managed Money’ traders grew faster still, reaching 78% of last year’s all-time record high.

Silver tracked gold prices Monday, retouching a 16-week high at $18.42 per ounce before slipping back.

Platinum rose to its strongest level in nearly 5 months at $1029 per ounce.

With Trump still to announce his fiscal policy, the new US president complained on Twitter at the weekend that the mainstream media haven’t reported the US national debt falling by $12bn during his first month in power, versus a $200bn rise in the first month of Barack Obama’s presidency.

Worldwide sovereign debt is set to reach a new record high of $44 trillion this year, according to an estimate from financial information providers S&P Global, despite a slight reduction in governments’ annual borrowings.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply