Gold SIPP providers and gold pension specialist listings

With a Self Invested Personal Pension (SIPP) the UK Government will pay up to 45% of the cost of any gold bullion you add to your pension plan, making a SIPP an incredibly useful vehicle for investing in physical bullion.

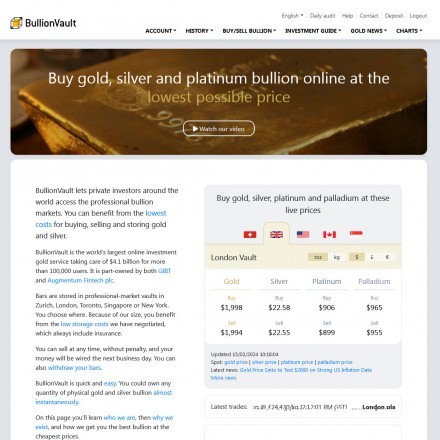

This page lists specialist gold SIPP providers – that is bullion dealers providing only or primarily working with gold pension accounts and gold SIPP administrators.

All non-specialist Gold SIPP providers are listed in our regular UK bullion dealer directory.

Bullion.Directory always advises investors looking to add gold or silver to their SIPP, or other eligible pension to compare dealer offerings, their fees and service charges. Because these costs can vary considerably from dealer to dealer, we recommend you speak to at least 3 gold SIPP providers and get a written copy of their scale of fees, premiums and service or storage charges before making any decisions.