Precious Metals Market Report

Thursday 8 June, 2017

Fundamentals and News*

Japan Stocks Rise as Yen Weakens, Pound Steady

A weaker yen supported Japanese stocks, with equities elsewhere mixed as investors awaited key events. Oil nudged higher after a plummet in crude prices.

Banks and exporters led gains on Japan’s Topix index, while Australian shares declined. Oil recovered just a small portion of the more than 5 percent plunge triggered by data showing a rise in U.S. crude stockpiles. Traders seem reluctant to add any big positions before Chinese trade data, the European Central Bank’s press conference on its policy decision, the U.K. election and former FBI Director James Comey’s Senate testimony.

A pivotal day for capital markets on Thursday comes as renowned bond investor Bill Gross said levels of risk in markets are at the highest since before the 2008 financial crisis. Equity investors have been prepared to place their faith in an expanding global recovery, while fixed-income money managers have dialed back inflation expectations in the U.S.

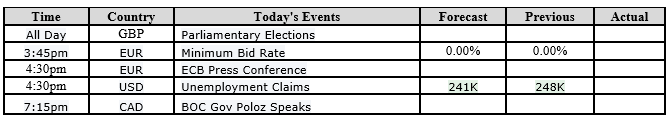

Here are some of the key upcoming events:

First up, it’s the China trade data.

The ECB’s policy decision Thursday is followed by Mario Draghi’s address to reporters later in the day. Don’t expect policy changes, but the central bank may drop the reference to “downside” risks to growth, while reiterating a weak inflation outlook, Bloomberg Intelligence said.

Surveys of U.K. voters over the past few weeks have indicated a tightening race for Thursday’s election, increasing the chance that Prime Minister Theresa May might not bolster her majority.

Comey released prepared testimony saying the president asked him to end an investigation into the former national security adviser.

Futures on the S&P 500 were little changed as of 9:12 a.m. in Tokyo after the underlying gauge added 0.2 percent on Wednesday.

The Topix index rose 0.1 percent. Australia’s S&P/ASX 200 Index fell 0.6 percent and South Korea’s Kospi index lost 0.1 percent.

WTI crude added 0.5 percent to $45.96 a barrel. Oil lost more than 5 percent Wednesday after an unexpected increase in U.S. crude and gasoline stockpiles stoked fears that the global supply glut will remain unabated.

The pound traded at $1.2966, up less than 0.1 percent.The yen was little changed at 109.87 per dollar after falling 0.4 percent Wednesday

(*source Bloomberg)

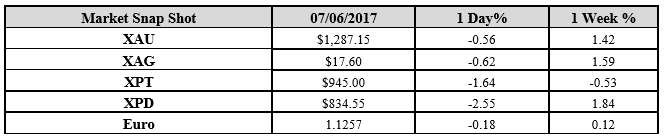

Data – Forthcoming Release

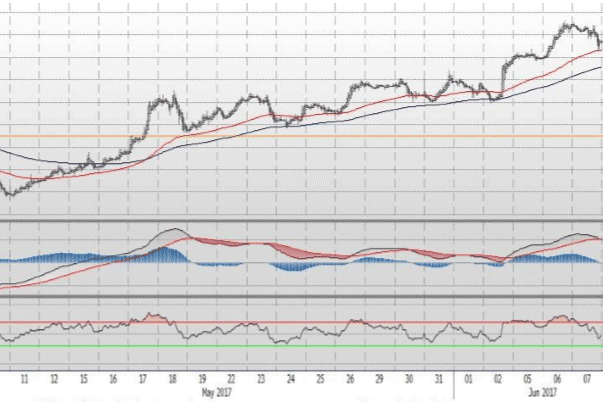

Technical Outlook and Commentary: Gold

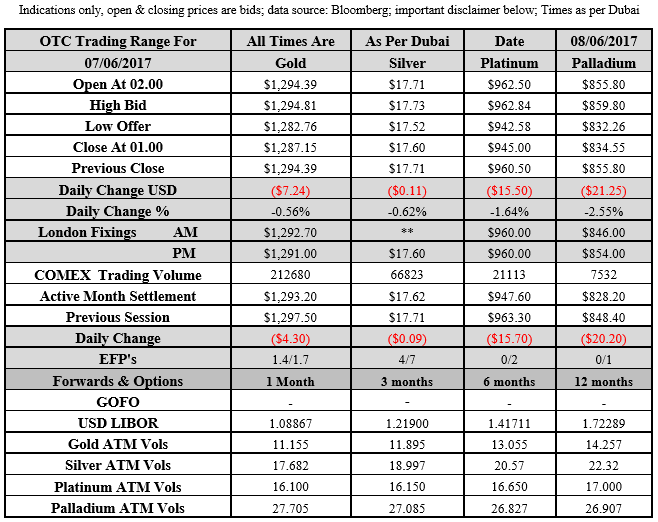

Gold for Spot delivery was closed at $1287.15 an ounce; with loss of $7.24 or 0.56 percent at 1.00 a.m. Dubai time closing, from its previous close of $1294.39

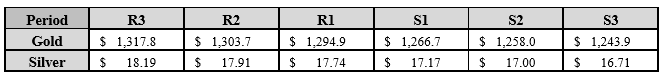

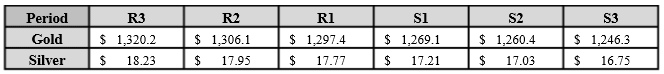

Spot Gold technically seems having resistance levels at 1294.9 and 1303.7 respectively, while the supports are seen at $1266.7 and 1258.0 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.60 with loss of $0.11 or 0.62 percent at 1.00 a.m. Dubai time closing, from its previous close of $17.71

The Fibonacci levels on chart are showing resistance at $17.74 and $17.91 while the supports are seen at $17.17 and $ 17.00 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply