Precious Metals Market Report

Monday 24 July, 2017

Fundamentals and News*

Stocks Fall Before Earnings Flurry, Fed; Euro Gains

Stocks in Asia dropped in early trading ahead of a week packed with earnings results and a Federal Reserve interest-rate decision. The euro extended gains.

Equities gauges were down in Japan, Australia and South Korea and oil extended declines before an OPEC meeting on Monday. The dollar set a fresh 14-month low and the euro added to recent gains with the greenback near to a technical level that some say will precede more losses.

Earnings season and changes in central bank policy are providing the latest tests for the bullmarket in equities that’s propelled the value of global shares to $78 trillion. Results at industry bellwethers from Amazon.com Inc. to GlaxoSmithKline Plc and Credit Suisse Group AG are due this week. The Fed is expected to stand pat, with investors looking to the accompanying statement for clues on how officials plan to start reducing the balance sheet.

Australia’s inflation probably slowed in the second quarter, possibly below the Reserve Bank of Australia’s target of between 2 percent and 3 percent, forecasts show ahead of the release on Wednesday.

Japanese June data also due this week may show sluggish CPI, even amid a tightening labor market and increased household spending.

China posts industrial profits for last month, with early indicators pointing upward.

Fed chief Janet Yellen is in something of a bind: inflation remains muted and the job market robust. As a result, the central bank is expected to make no change to policy on Wednesday with investors and economists parsing the statement for clues on how officials plan to proceed in reducing their massive portfolio.

Japan’s Topix index slid 0.7 percent. Australia’s S&P/ASX 200 Index lost 0.3 percent and South Korea’s Kospi index was little changed.

The yen climbed 0.2 percent to 110.96 per dollar as of 9:01 a.m. in Tokyo, a fifth day of gains. The euro bought $1.1680.

WTI crude lost 0.1 percent in early Monday trading to $45.72 a barrel. Limiting output from Nigeria and Libya, which are exempt from the curbs, won’t be on the agenda when the Organization of Petroleum Exporting Countries and its partners meet Monday in St. Petersburg, according to people familiar with planned talks.

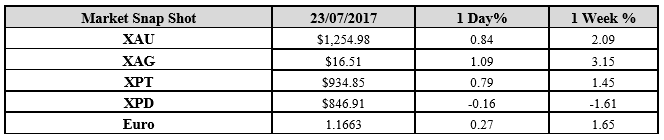

Gold rose 0.1 percent to $1,256.22 an ounce having climbed the past two weeks.

The yield on the 10-year Treasury note slipped one basis point to 2.23 percent.

(*source Bloomberg)

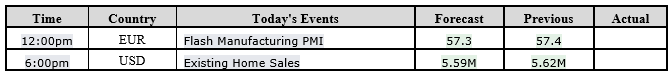

Data – Forthcoming Release

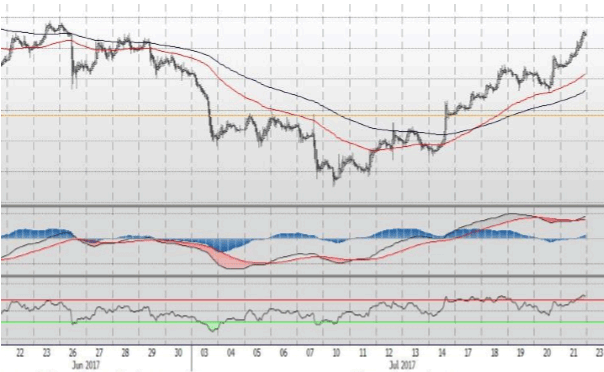

Technical Outlook and Commentary: Gold

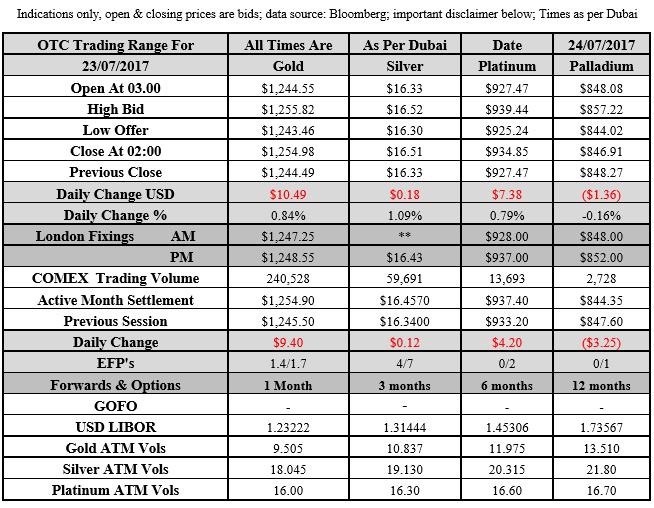

Gold for Spot delivery was closed at $1254.98 an ounce; with gain of $10.49 or 0.84 percent at 1.00 a.m. Dubai time closing, from its previous close of $1244.49

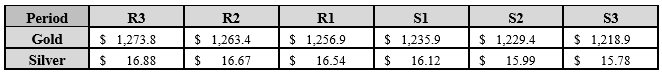

Spot Gold technically seems having resistance levels at 1256.9 and 1263.4 respectively, while the supports are seen at $1235.9 and 1229.4 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.51 with gain of $0.18 or 1.09 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.63

The Fibonacci levels on chart are showing resistance at $16.54 and $16.67 while the supports are seen at $16.12and $ 15.99 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply