Precious Metals Market Report

Wednesday 22 March, 2017

Fundamentals and News

The Daily Prophet: This May Be the Day the Trump Trade Died

(Bloomberg)

Maybe investors should forget the Trump trade and start prepping for the Trump correction. U.S. stocks had their worst day since October. The dollar can’t seem to find a bottom. There’s no rebound in sight for oil. Havens such as Treasuries and gold are back in vogue. There’s an undeniable “risk off” vibe reverberating through markets.

The optimism that accompanied Donald Trump’s U.S. election victory was built on a trinity of lower taxes, infrastructure spending and regulatory reform. Now, doubts are rising about any of those being realized, even with Republicans controlling the White House and Congress. The Obamacare replacement bill i sstruggling to gain support from House conservatives and Senate Republicans, and some GOP lawmakers argue that a once-in-a-generation opportunity to overhaul the U.S. tax code with cuts for businesses and individuals depends on the outcome. Bank, industrial and technology shares — some of the biggest beneficiaries of the Trump trade — were the biggest losers.

It’s a nerve-racking time for investors, who have pushed equity valuations to record highs. Nobel Prize-winning economist Robert Shiller recently said the last time he remembers equity investors being as bullish as they are now was in 2000, and that didn’t end well. “The amazing run the market has had since the election left no room for error, delay or issues of any kind,” Peter Boockvar, chief market analyst at Lindsay Group, wrote today in a research note.

DOLLAR CAPITULATION If markets truly believed that Trump’s policies would juice the economy and spark faster inflation, then the dollar would be a prime beneficiary — except the greenback is on an epic slump. The Bloomberg Dollar Spot Index has fallen for five straight days, the longest stretch of declines since the week before the election. The gauge dropped today to its lowest level since Nov. 10. Bank of America Corp. said based on what it sees in terms of market positioning, sentiment surveys conducted with its clients, and publicly available futures data, bullish dollar positions put on after the election have completely disappeared, according to Bloomberg News’s Andrea Wong. What makes the recent weakness even more compelling is that it comes largely at the expense of gains in the euro, which is on a tear even as Europe faces its own political uncertainty with pending elections in France and Germany, as well as new debt troubles in Greece.

(*source Bloomberg)

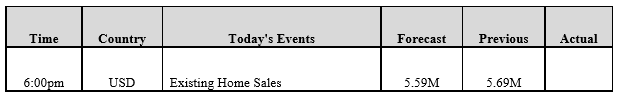

Data – Forthcoming Release

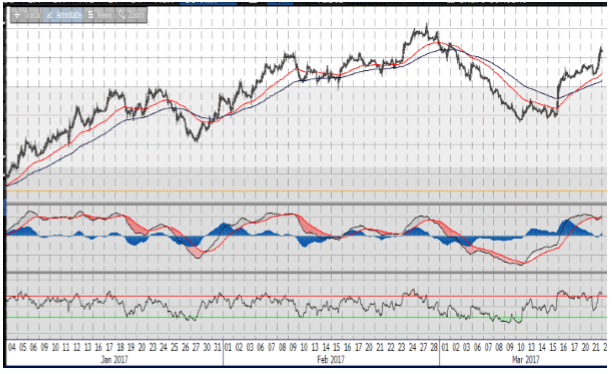

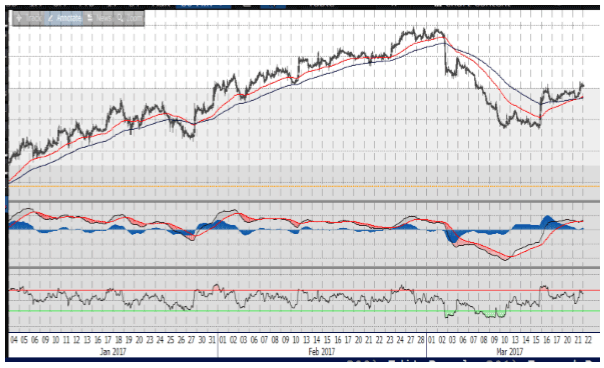

Technical Outlook and Commentary: Gold

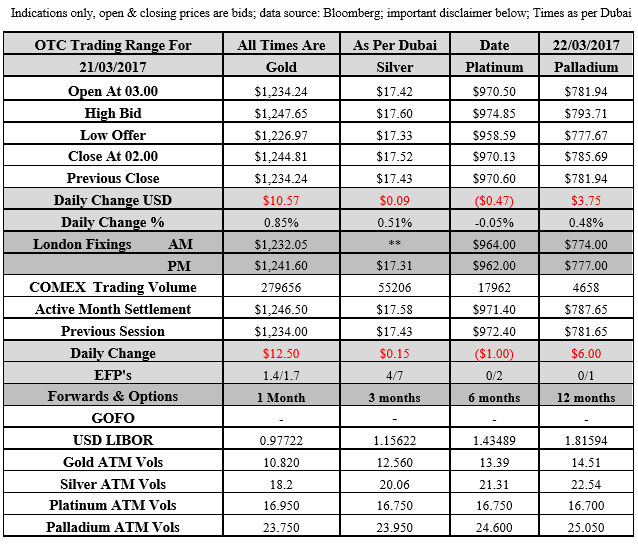

Gold for Spot delivery was closed at $1244.81 an ounce; with gain of $10.57 or 0.85 percent at 2.00 a.m. Dubai time closing, from its previous close of $1234.24

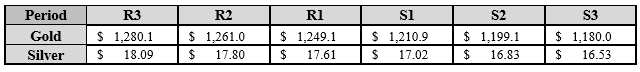

Spot Gold technically seems having resistance levels at 1249.10 and 1261respectively, while the supports are seen at $1210.9 and 1199.10 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.52 an ounce; with gain of $0.09 or 0.51 percent at 2.00 a.m. Dubai time closing, from its previous close of $17.43

The Fibonacci levels on chart are showing resistance at $17.61 and $17.80 while the supports are seen at $17.02 and $ 16.83 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply