Precious Metals Market Report

Wednesday 2 August, 2017

Fundamentals and News*

Technology Shares in Asia Gain on Apple Results

Asian technology stocks climbed with U.S. equity-index futures after results from Apple Inc.

Nasdaq futures advanced after Apple projected revenue in the current quarter that topped analysts’ estimates, while shares of Honda Motor Co. gained in Tokyo trading following the company’s higher profit forecast. The kiwi sank after hiring declined unexpectedly in New Zealand. Treasuries were steady after climbing with the dollar as data gave mixed signals on the strength of American economic growth. A drop in the Bloomberg Commodity Index weighed on raw-material producers in Asia after a stellar run.

Over in India, the central bank is expected to ease policy and announce steps to absorb excess bank liquidity after consumer prices slowed sharply. Policy makers will probably cut the benchmark rate by 25 basis points to 6 percent, economists said.

Meanwhile, bets on Venezuelan default are climbing and the implied probability of a missed payment over the next year has risen to 64 percent, according to data compiled by Bloomberg. The government’s $3 billion of bonds due in 2022 fell to a 15-month low and traded at 41 U.S. cents on Tuesday after President Nicolas Maduro moved closer to imposing authoritarian rule in the country.

U.S. jobs data on Friday will probably show employers added about 180,000 workers in July.

Japan’s Topix index gained 0.3 percent. Australia’s S&P/ASX 200 Index fell 0.3 percent and South Korea’s Kospi index added 0.2 percent.

Nasdaq 100 futures climbed 0.7 percent as of 9:02 a.m. in Tokyo. Apple shares rose more than 6 percent in after-hours trading, putting the stock on course for a record high when regular trading starts. S&P 500 e-mini futures were up 0.1 percent.

Futures on Hong Kong’s Hang Seng Index were flat.

The MSCI All-Country World Index rose 0.5 percent to close at an all-time high on Tuesday.

The kiwi slide 0.5 percent to 74.28 U.S. cents. Read more on New Zealand’s jobs report here.

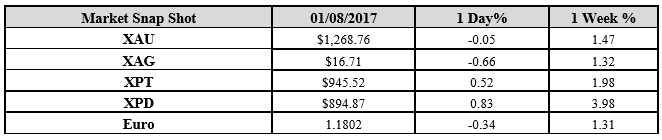

The euro bought $1.1805 after slipping 0.3 percent on Tuesday.

The Bloomberg Dollar Spot Index was little changed. It rose 0.2 percent on Tuesday.

10-year Australian government notes saw yields drop three basis points to 2.68 percent.

Commodities:

West Texas Intermediate crude retreated from above $50, falling 0.7 percent to $48.82 a barrel. The contract fell 2 percent on Tuesday, the first decline in more than a week, after an industry report was said to show U.S. crude inventories unexpectedly jumped.

(*source Bloomberg)

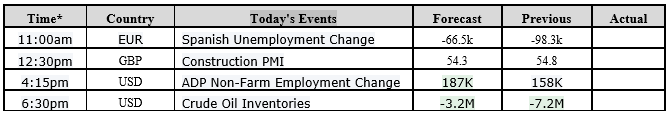

Data – Forthcoming Release

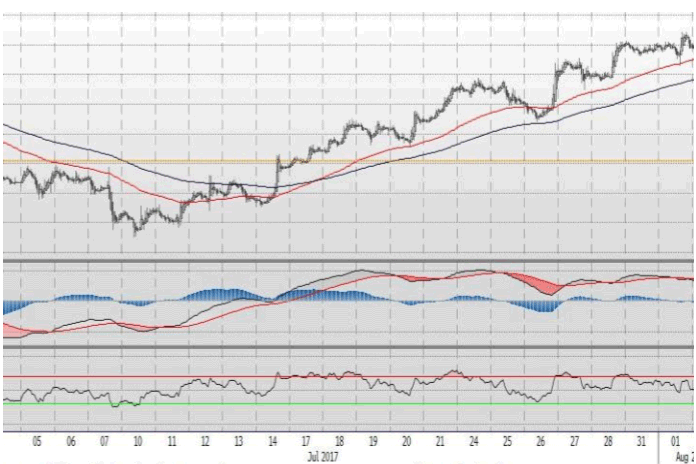

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1269.44 an ounce; with little change of $0.20 or -0.02 percent at 1.00 a.m. Dubai time closing, from its previous close of $1269.64

Spot Gold technically seems having resistance levels at 1272.0 and 1278.4 respectively, while the supports are seen at $1251.1 and 1244.6 respectively.

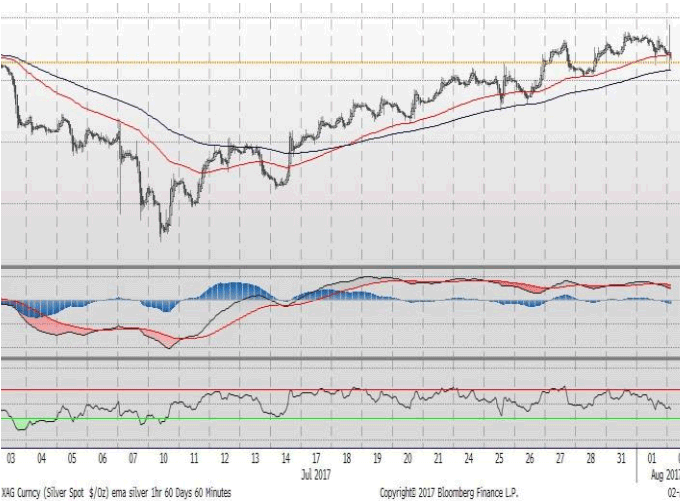

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.82 with the gain of $0.07 or 0.42 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.75

The Fibonacci levels on chart are showing resistance at $16.89 and $17.04 while the supports are seen at $16.41and $ 16.26 respectively.

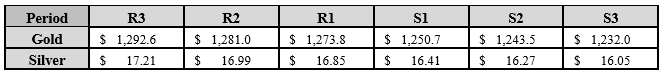

Resistance and Support Levels

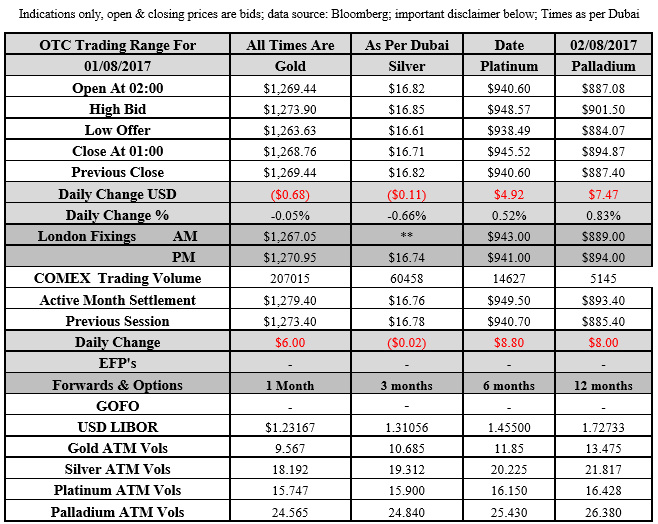

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply