Precious Metals Market Report

Wednesday 14 June, 2017

Fundamentals and News*

Best Commodity in 2017 Is One of the Smallest Metals Markets

In the main commodity markets, nothing is doing better thanpalladium this year.

The metal is up 32 percent, beating 33 other raw materials, including lean hogs and aluminum, tracked by Bloomberg. On Friday, prices surged as much as 7.9 percent to a 16-year high of $928.36 an ounce as some traders were said to scramble to get hold of physical supplies. It was at $899.32 in London on Monday.

Palladium, which is mainly used to curb harmful emissions from gasoline vehicles, has rallied on expectations that supply will lag demand for a sixth straight year. It’s now almost as expensive as platinum for the first time since 2001, helped by Volkswagen AG’s emissions scandal two years ago that has prompted consumers to switch from diesel to gasoline cars.

“The fundamentals in palladium are among the best in all the commodities,” said Rene Hochreiter, an analyst at Noah Capital Markets Pty Ltd. in Johannesburg. “It could easily overtake platinum in the near-term. It feels as if the rally has got legs.”

Mine production hasn’t been able to keep up with usage since 2012, partly because of rising car sales and stricter emissions limits. While stockpiled metal probably helped feed consumer demand in recent years, that source of supply may now be running out, according to Caroline Bain, chief commodities economist at Capital Economics Ltd.

The futures market is signaling traders are rushing to buy metal. Palladium for June delivery in New York has become a lot more expensive than the March 2018 contract in recent weeks. That’s indicating there may be concerns about near-term supplies.

(*source Bloomberg)

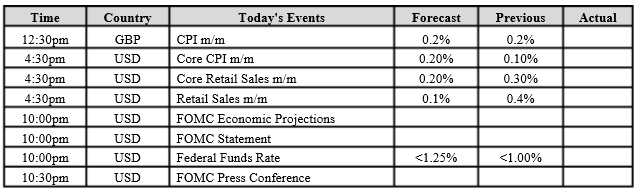

Data – Forthcoming Release

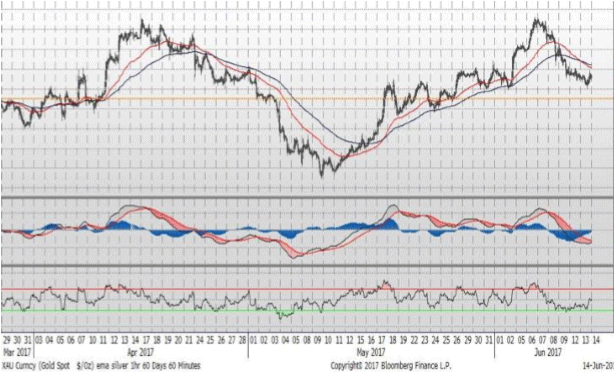

Technical Outlook and Commentary: Gold

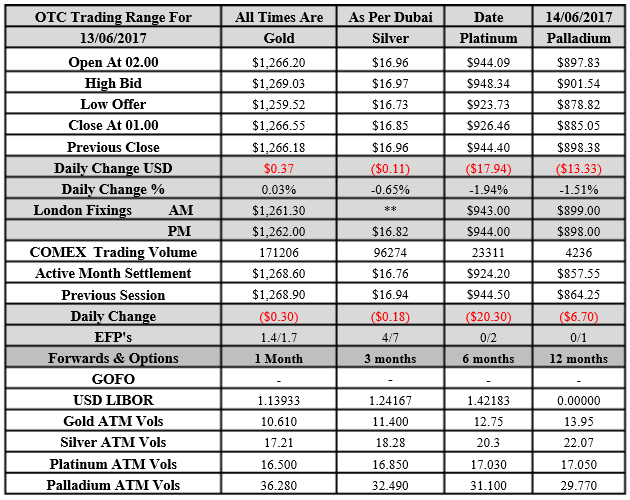

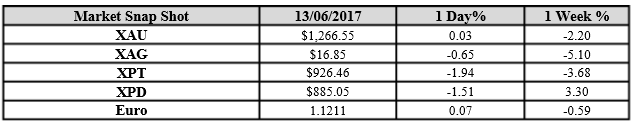

Gold for Spot delivery was closed at $1266.55 an ounce; with gain of $0.40 or 0.03 percent at 1.00 a.m. Dubai time closing, from its previous close of $1265.95

Spot Gold technically seems having resistance levels at 1287.4 and 1295.8 respectively, while the supports are seen at $1260.1 and 1251.7 respectively.

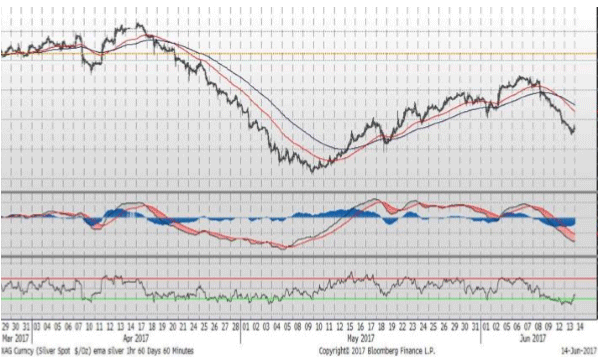

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.85 with loss of $0.11 or -0.65 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.96

The Fibonacci levels on chart are showing resistance at $17.49 and $17.72 while the supports are seen at $16.72 and $ 16.49 respectively.

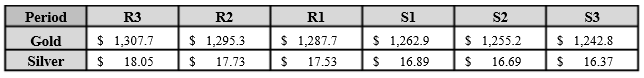

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply