Precious Metals Market Report

Monday 10 April, 2017

Fundamentals and News

Dollar Rises, Treasuries Retreat as Stocks Slip: Markets Wrap

(Bloomberg)

U.S. stocks ended a volatile session lower, while the dollar advanced with Treasury yields as investors looked past a U.S. military strike in Syria and worse-than-forecast hiring data.

The S&P 500 Index slipped amid volume 15 percent lower than the 30-day average, while the greenback capped its best week in two months. Comments from the Fed Bank of New York president bolstered speculation it bank won’t slow the pace of rate hikes as it trims its balance sheet. The 10-year Treasury yield topped 2.35 percent after falling as low as 2.28 percent amid a weak jobs report and the first military strike undertaken by President Donald Trump’s administration.

Financial markets showed resilience in the face of weaker-than-forecast hiring in the world’s largest economy and a ratcheting up of geopolitical tensions, with demand for haven assets abating. Volatility across equity markets came down from highs reached overnight. New York Fed President William Dudley’s comments come two days after Fed meeting minutes signaled officials discussed the timing for shrinking the central bank’s balance sheet as it tightens monetary policy.

“I would think we’d be seeing more risk off with everything that could happen into the weekend with Syria, to the continued lengthening of the tax plan timeline, as well as Dudley’s comments,” Andrew Brenner, head of international fixed income for National Alliance Capital Markets, said by phone. “But there’s a short base out there and people are under-invested in equities and very negative, which always keeps a bid into the market.”

U.S. Secretary of State Rex Tillerson will on Sunday attend the Group of Seven gathering in Italy and next week meet with Russian counterpart Sergei Lavrov in Moscow.

Argentina, Brazil, Canada, Chile and South Korea are among countries setting interest rates next week.

U.S. banks will start reporting first-quarter earnings, led by Citigroup Inc., JPMorgan Chase & Co., and Wells Fargo & Co.

The S&P 500 fell 0.1 percent to 2,355.58 as of 4 p.m. in New York. Futures fell as much as 0.7 percent in the hour after Thursday night’s attack in Syria.

The CBOE Volatility Index rose 3 percent, paring a gain that topped 6 percent.

The Stoxx Europe 600 Index added 0.1 percent. Volatility measures from Hong Kong to Europe increased.

The Bloomberg Dollar Spot Index advanced 0.3 percent, rebounding from earlier losses as it heads for a weekly advance of 0.6 percent.

The ruble dropped 1.5 percent. The currency has been trading near the highest since July 2015. President Vladimir Putin believes the U.S. airstrikes caused “considerable damage” to relations with Russia, a Kremlin spokesman said.

The yen weakened 0.4 percent to 111.198 after erasing gains of as much as 0.6 percent. The euro slipped 0.3 percent, the British pound dropped 0.6 percent.

South Africa’s rand touched the weakest level this year after Fitch Ratings became the second company to cut the country’s credit assessment to junk. It traded at 13.809 per dollar, lower by 0.4 percent.

West Texas Intermediate crude added 1 percent to settle at $52.245, after touching the highest in a month. Oil rose about 3 percent for the week.

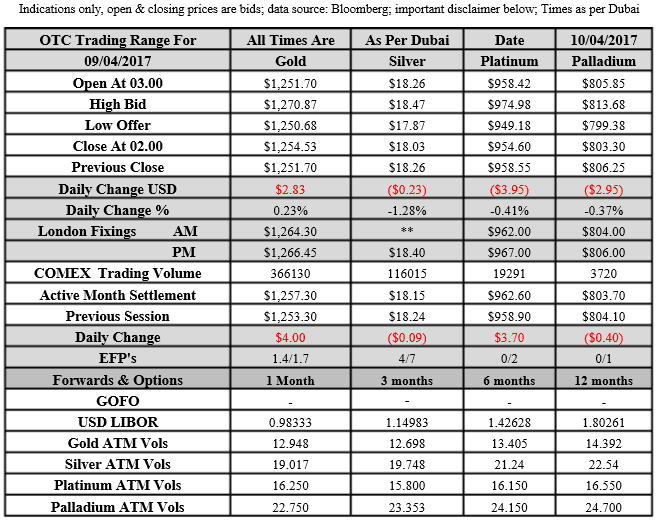

Gold futures rose 0.3 percent to $1,256.90. The metal climbed more than 1 percent earlier in the session to the highest since November, following two days of declines.

(*source Bloomberg)

Data – Forthcoming Release

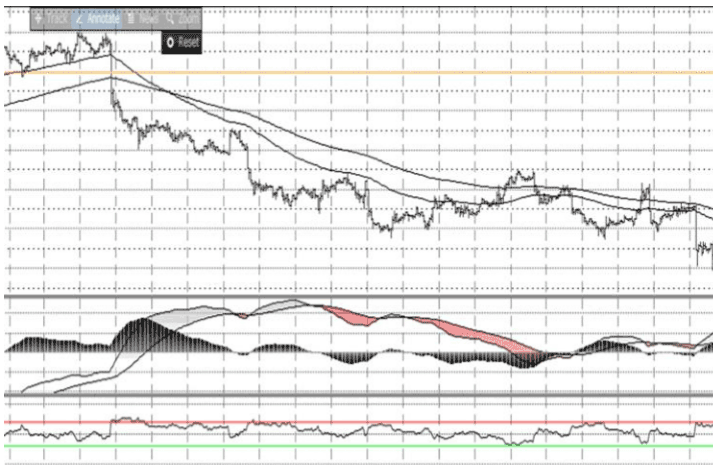

Technical Outlook and Commentary: Gold

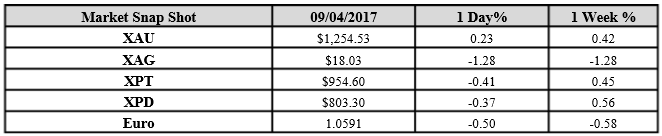

Gold for Spot delivery was closed at $1254.53 an ounce; with gain of $2.83 or 0.23 percent at 1.00 a.m. Dubai time closing, from its previous close of $1251.7

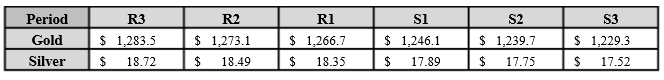

Spot Gold technically seems having resistance levels at 1266.7 and 1273.1 respectively, while the supports are seen at $1246.1 and 1239.7 respectively.

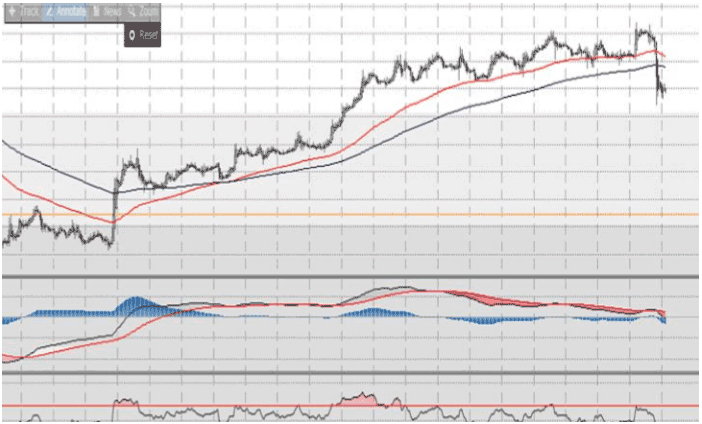

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.03 an ounce; with loss of.23 cent at 1.00 a.m. Dubai time closing, from its previous close of $18.26

The Fibonacci levels on chart are showing resistance at $18.35 and $18.49 while the supports are seen at $17.89 and $ 17.75 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply