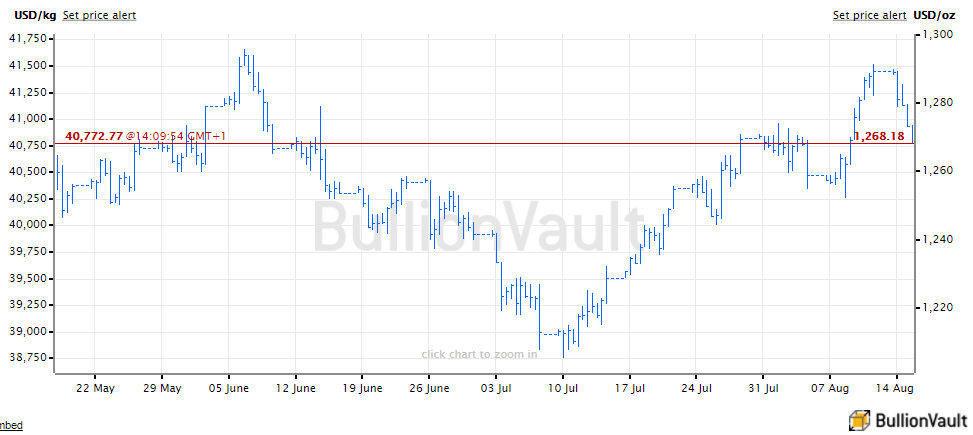

Gold Prices ‘Shed Crisis Premium’ as N.Korea’s Kim ‘Backs Down’ to ‘Foolish Yankees’

Bullion.Directory precious metals analysis 15 August, 2017

Bullion.Directory precious metals analysis 15 August, 2017

By Adrian Ash

Head of Research at Bullion Vault

As Washington’s Secretary of Defense James Mattis said it would be “game on” if Pyongyang attacked, the pariah state’s regime said it would wait and watch the next move from “the foolish Yankees” before sending “enveloping fire” at the US island and military base of Guam.

“We are very…I’d say almost ecstatic that Kim Jong Un has backed off,” said Guam Homeland Security Advisor George Charfauros.

“The yellow metal continued to see some of its recent risk premium wiped away during Asian hours today,” said Tuesday morning’s note from Swiss refiners and finance group MKS Pamp.

“Afternoon pricing did little to instil confidence in the metal, unable to settle above $1275 and looking likely to test lower into European hours.”

Shanghai premiums edged down to $6 per ounce Tuesday – one third below the average incentive to new imports – even as Yuan gold prices in the world’s No.1 consumer market fell to 3-session lows.

Amongst Western investment products, the giant SPDR Gold Trust (NYSEArca:GLD) yesterday continued to act against type, growing for the first time since 26 June as gold prices fell from Friday’s highest weekly close in Dollar terms since before Donald Trump won the US presidential election last November.

“Global tensions seem now to be ratcheting down,” Reuters today quotes French investment bank Societe Generale’s head of metals research Robin Bhar.

“[So] investors are looking to liquidate [gold] and pick up some more risky assets.”

“It was particularly the threat of a military conflict in East Asia that had driven the gold price up sharply last week,” agrees today’s commodities note from German financial services group Commerzbank.

“However, speculative financial investors also caused the price to climb by opening long positions in anticipation of a rising gold price.

“These investors are now likely to take profits, pushing the price back down again.”

“Lower US real yields and a lower US Dollar were [in fact] the usual suspects,” counters Dutch bank ABN Amro’s precious metals analyst Georgette Boele in a new note.

“[But as] we don’t expect a full-blown crisis concerning North Korea…safe-haven demand for gold and to a lesser extent silver and platinum will probably ease…before another test of $1300.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply