Gold Prices Hit 3-Week Low as UK GDP Makes Rate Rise a ‘Done Deal’, GOP Back Taylor Rule at US Fed

Bullion.Directory precious metals analysis 25 October, 2017

Bullion.Directory precious metals analysis 25 October, 2017

By Adrian Ash

Head of Research at Bullion Vault

UK government Gilt yields jumped to their highest since February followed stronger-than-expected GDP growth for Q3, while US 10-year Treasury yields rose to fresh 7-month highs of 2.45% after news reports said Republican lawmakers advised President Trump to pick “hawkish” economist John Taylor as the next chair of the Federal Reserve.

“Nothing less than the big ‘taper’ plan for next year is expected from Mario Draghi” at tomorrow’s European Central Bank press conference, says CNBC.

Eurozone stock markets edged higher on Wednesday but London’s FTSE100 slipped and the UK-focused FTSE250 held flat after new GDP figures said economic growth held at 1.5% per year in the third quarter of 2017.

The last major data release before next week’s Bank of England interest-rate decision, that just beat analyst forecasts but still put GDP growth at the slowest in almost 5 years, with the construction sector technically in “recession” by shrinking for the second quarter in a row.

Sterling jumped almost 1.5 cents against the Dollar to a 1-week high above $1.32.

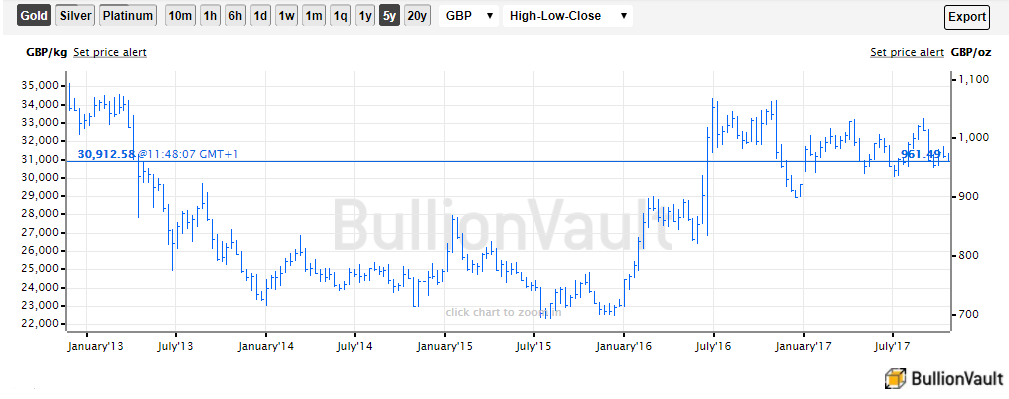

That sank the UK gold price in Pounds per ounce by £10 to £960, the lowest level since early October.

Despite fears of an underlying slowdown as Brexit talks wear on, “The GDP data suggest the UK could stomach a rate rise,” says one London fund manager.

With UK inflation already at 5-year highs, today’s data ” probably sealed the deal” on a rate rise next month from the current record-low 0.25% adds an economist.

Reporting Tuesday’s GOP “vote” on the next Fed chair meantime, “Trump only asked about [current Fed governor Jerome] Powell and Taylor,” says one report, “and most senators simply smiled instead of raise a hand for either candidate.”

Prior to current chair Janet Yellen’s term ending in February, December’s US rate rise to a ceiling of 1.50% is now virtually certain according to betting on CME futures contracts.

From there to September 2018, the odds of “no change” have fallen over the last month from stronger than 1-in-3 towards just 1-in-5.

“Speculation about higher interest rates in the US is weighing on the gold price,” says the latest Commodities Daily from German financial services group Commerzbank.

“If [Trump] does indeed choose Taylor, gold is likely to fall sharply.”

First proposed in a 1993 paper, the Stanford academic’s so-called Taylor Rule “calls for interest rates significantly higher than they are now,” says a story on Bloomberg.

“But [Taylor’s] support of tax cuts [by the Trump admininstration] may make him reluctant to hike rates.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply