…As Fed’s Yellen Gets 90% Odds of December Rate Hike

Bullion.Directory precious metals analysis 17 November, 2016

Bullion.Directory precious metals analysis 17 November, 2016

By Adrian Ash

Head of Research at Bullion Vault

European stockmarkets fell for a second session running, pulling the EuroStoxx 50 index of major companies down towards a 1-week low after European Central Bank policymaker Yves Mersch told an audience in Frankfurt, Germany, that its bond-buying money creation QE scheme – now worth €80 billion per month, but due to expire in March 2017 – cannot become “a permanent commitment.

“[That] would set the wrong incentives for government financing.”

Commodities rose, led by a 1% bounce in crude oil, as government bonds fell again, pushing secondary-market interest rates higher for the 8th consecutive day since Donald Trump won the US presidential election.

A rate hike “could well become appropriate relatively soon” said Fed chief Yellen in scheduled testimony to the US Congress’ Joint Economic Committee in Washington today, provided that “incoming data provide some further evidence of continued progress.”

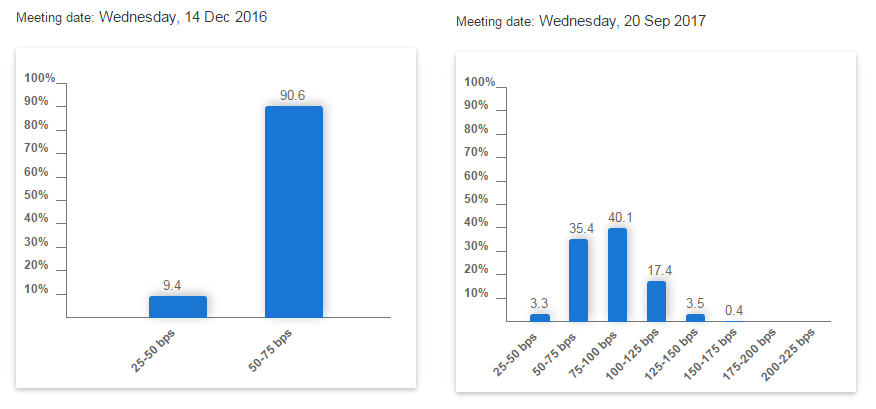

Betting on US interest-rate futures now puts the odds of a December rate hike above 90%, according to the CME’s FedWatch Tool.

But the odds of a third Fed hike, up to a ceiling of 1.00% after finally rising from zero in December 2015, don’t reach evens or stronger until September 2017 on current betting.

“I think the overreaction in fixed-income markets is coming to an end, and that means that the sell-off and over-reaction in gold is also coming to an end,” Reuters today quotes strategist Tom Kendall at Chinese-owned bullion market maker ICBC Standard Bank in London.

“We still expect the Fed to lift benchmark rates by 25 basis-points in December,” Kendall said in a note earlier this week, “but that will now just be catching up with the rest of the yield curve.”

With US mortgage rates closely tied to longer-dated Treasury yields – now almost half-a-percentage point higher on 10-year bonds from this time last month – “A sudden rise in lending rates will be a shock to the system that underpins a substantial part of the US economy,” Kendall warns.

“If the real estate market does slow in 2017 that will be yet another…serious impediment to the Fed raising its benchmark rate further.

“So we think the rationale for investors to build and hold positions in gold will likely be stronger in 2017, not weaker.”

Looking at the surge meantime in industrial metal prices since Trump’s victory – most notably copper – “US consumption of base metals at between 8-9% of global consumption pales into insignificance when compared with China,” says analyst Robin Bhar at French investment and bullion market-making bank Societe Generale.

China accounts for 45-55% of global base metals consumption on Bhar’s figures, at least 5 times the US level.

“[So] the current rally has much more to do with China, we believe…[and] optimism based largely on the ongoing infrastructure spending that is underway and boosted by recent announcements from the state planner (the NDRC) on increased investment in the power grid and railway network.”

In contrast, says the SocGen note, “Doubts remain whether Trump can deliver on his campaign pledge to boost [US] infrastructure spending” thanks to Republican Party worries about increasing Washington’s deficit spending as Trump also moves to cut tax rates.

Having held firm as copper soared late last week, silver prices again tracked gold bullion lower on Thursday, dropping back below $17 per ounce to trade over 2.5% lower for the week so far.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply