The Voting Public Have Spoken… And The Finalists Are:

Bullion.Directory precious metals news 12 December, 2016

Bullion.Directory precious metals news 12 December, 2016

By Alison Macdonald

Commercial Editor at Bullion.Directory

USA Finalists

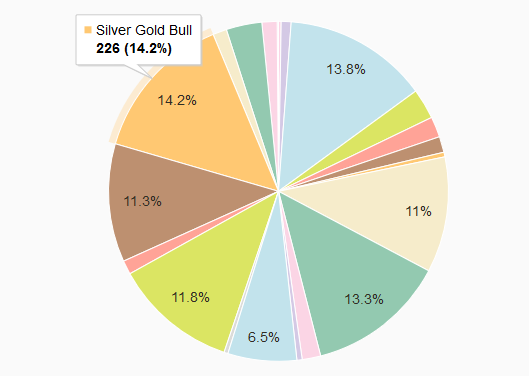

After a total of 1591 nominations, the USA Category turned out to be an incredibly tight vote with little separating the top 5 nominations – a mere 7 votes stood between the #1 and #2 spot – and only 47 nominations came between the #1 and #5 finalists.

Canadian-based Silver Gold Bull were surprise winners in the nominations, a sure sign of their continuing aggressive growth into the US market.

Gold IRA specialists American Bullion and Regal Assets were close 2nd and 4th, with the national dealers JM Bullion in 3rd and leading US mint Scottsdale Mint in 5th spot.

Canada Finalists

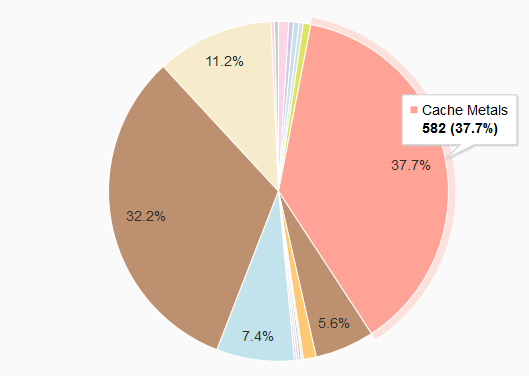

#1 Cache Metals 37.7% (582 votes)

#2 Silver Gold Bull 32.2% (497 votes)

#3 Sprott Money 11.2% (172 votes)

#4 Kitco 7.4% (114 votes)

#5 Canadian Bullion Services 5.6% (87 votes)

From a total of 1542 nominations, the Canadian Category saw a fierce battle between two of Canada’s best-known bullion dealers – a fight where these two companies took a combined 70% of the public vote.

With 38.8% of all Canadian nominations, Cache Metals took the first spot seeing Silver Gold Bull off to second, despite their impressive 32.2% share of the vote. Silver Gold Bull did however take first place in the USA vote.

Sprott Money saw a comfortable third placing, with international dealers Kitco claiming the fourth spot and Canadian Bullion Services getting into the finals with 5.6% of the nominations

UK Finalists

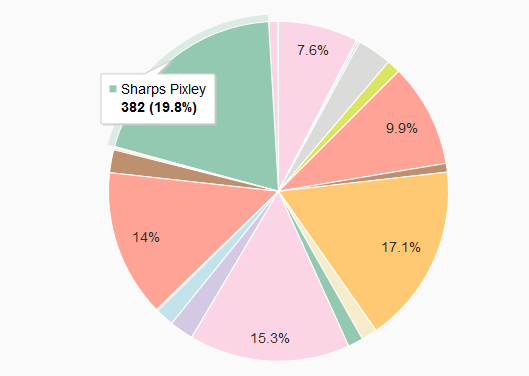

#1 Sharps Pixley 19.8% (382 votes)

#2 Chard 1964 Ltd 17.1% (329 votes)

#3 Goldcore 15.3% (295 votes)

#4 Physical Gold 14.0% (270 votes)

#5 Bullion Vault 9.9% (190 votes)

From a total of 1927 nominations, the UK Category saw a decisive nomination for London-based national dealer Sharps Pixley taking almost 20% of the British vote.

Two-times winner Chard return for 2017’s vote, with 329 well deserved nominating votes following a strong social campaign.

Ireland’s Goldcore see the 3rd spot with 295 votes, leading gold pensions specialist Physical Gold become the 4th UK finalist for 2017 with Bullion Vault finishing the top five in the popular vote.

United Arab Emirates Finalists

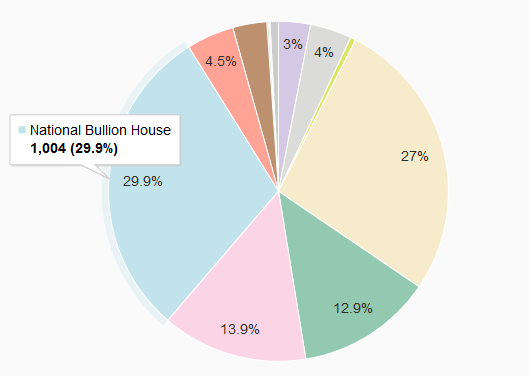

#1 NBH 29.9% (1004 votes)

#2 IGR 27.0% (908 votes)

#3 Leaf.ae 13.9% (466 votes)

#4 Kaloti 12.9% (435 votes)

#5 PAMP Gold 4.5% (152 votes)

From a total of 3363 nominations, the UAE Category saw a fierce battle between two of Dubai’s biggest bullion dealers, with them sharing 57% of the overall vote – and claiming the most nominations in any category.

National Bullion House received over 1000 nominations to take the first finalist spot, with Istanbul Gold Refinery in at a very close second with an equally impressive 908 votes.

Newcomer bullion dealer Leaf.ae saw a strong vote for third, with the 2016 UAE winners Kaloti returning to the 2017 final as the fourth nomination. PAMP‘s Dubai operation took the fifth finalist place.

Australia Finalists

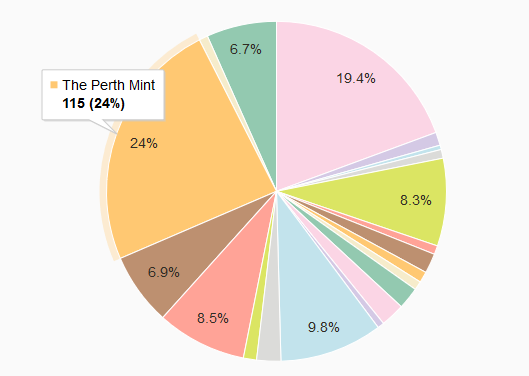

#1 Perth Mint 24.0% (115 votes)

#2 ABC Bullion 19.4% (93 votes)

#3 Jaggards 9.8% (47 votes)

#4 Perth Bullion Co. 8.5% (41 votes)

#5 Bullion Capital 8.3% (40 votes)

From a total of 480 nominations, The Perth Mint were the Australian bullion dealer with most nominations in the first public vote, taking almost 1/4 of the vote.

2016’s Australian winners ABC Bullion return for the 2017 public vote with 19.4% of overall nominations.

Jaggards take the third spot with 9.8%, Perth Bullion fourth at 8.5% and Bullion Capital the fifth place by a single vote.

Leave a Reply